May 2025 top M&A deals in emerging markets by region

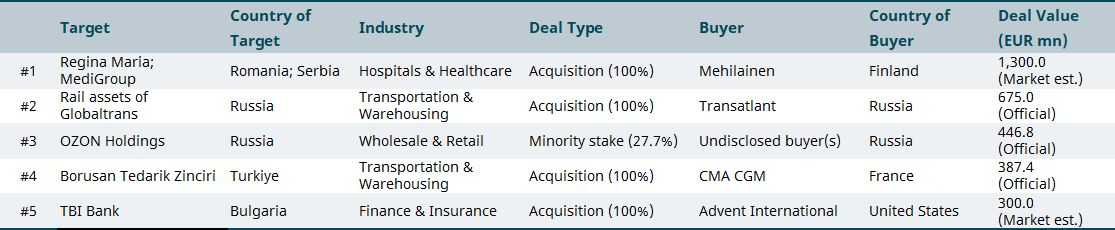

Eastern Europe

Finnish healthcare giant Mehiläinen has agreed to acquire Romanian network Regina Maria and Serbian provider MediGroup from UK-based private equity firm Mid Europa Partners in a landmark deal reportedly valued at nearly EUR 1.bn, including debt, according to Ziarul Financiar. The acquisition marks Mehiläinen’s strategic expansion into Central and Eastern Europe. It will leverage Regina Maria’s 63-site network and MediGroup’s 15 medical facilities to broaden services and strengthen regional growth.

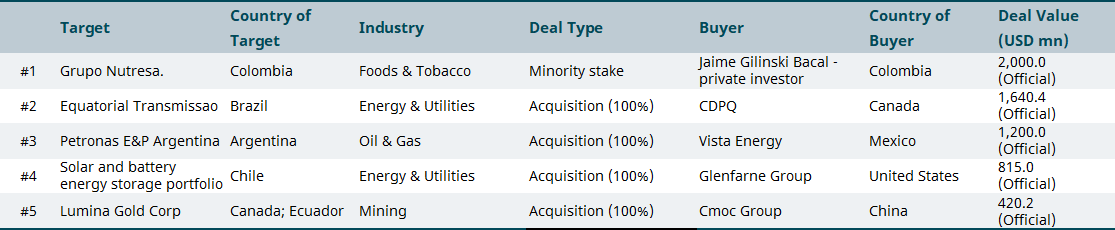

Latin America and the Caribbean

Colombian investor Jaime Gilinski Bacal has acquired full ownership of local credit intermediary Nugil in a USD 2bn deal, as announced by consumer goods group Grupo Nutresa. The acquisition makes Gilinski the indirect owner of 84.5% of Nutresa’s shares, since Nugil is a major shareholder in the company. Founded in 2020, Nugil has been instrumental in Gilinski’s financial maneuvers to gain control of Nutresa. The move solidifies Gilinski’s influence over one of Colombia’s leading food conglomerates, whose brand portfolio includes iconic names like Zenu, Noel, Jet, and Sello Rojo across meat, biscuits, chocolate, coffee, and more.

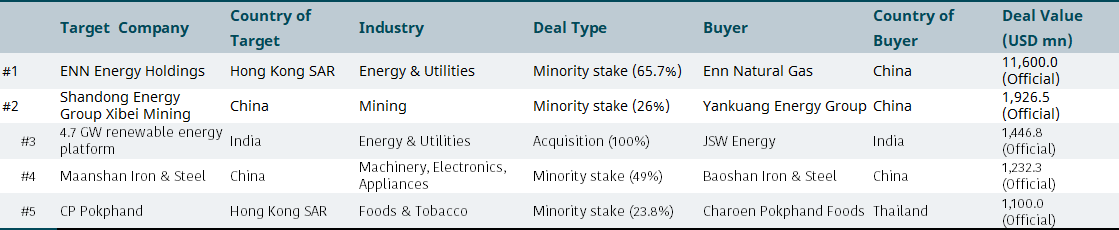

Emerging Asia

Chinese company ENN Natural Gas Co Ltd has announced the acquisition of a 65.7% stake in Hong Kong-listed ENN Energy Holdings Ltd for USD 11.6bn, consolidating full ownership of the clean energy distributor. ENN Energy, a major clean energy supplier with 2023 revenues of USD 16.1bn, manages extensive gas pipeline infrastructure across China. The ownership of ENN Natural Gas is predominantly held by the broader ENN Group, which is a large, private energy conglomerate in China.

Are you interested in M&A intelligence? Request a demo of our platform here